Whatfix is ramping up its AI innovations, expecting them to contribute a substantial 20% of its revenue by the end of 2026. This growth strategy aligns with the company’s ambitious plans to go public within the next two years, marking a pivotal moment for the SaaS firm at the forefront of digital adoption. Originating as a provider of interactive overlays that guide users through complex software workflows, Whatfix has evolved its offerings through strategic AI integration, aiming to enhance user experience, automation, and enterprise productivity. As the digital landscape increasingly prioritizes intelligent automation, Whatfix’s focus on AI highlights the transformative potential of tech-driven solutions in improving software adoption and analytics. This article explores how Whatfix is leveraging AI to propel its SaaS platform, optimize digital adoption, and prepare for its forthcoming IPO, all while navigating the competitive pressures of the global tech market.

How Whatfix is Leveraging AI Innovations to Drive SaaS Revenue Growth

Whatfix’s strategic emphasis on AI represents a major shift in how it envisions revenue generation and product development. Currently, AI-related products contribute a modest 1.5% to Whatfix’s overall revenue, but this is expected to surge more than thirteenfold within 18 months, reaching at least 15% to 20% by the end of 2026. This dramatic growth is set to occur as part of the company’s broader focus on digital adoption and automation, bringing smarter tools to enterprise users worldwide.

The company’s core offering revolves around its Digital Adoption Platform (DAP), which uses interactive “nudges” or tooltips to ease software onboarding and workflows. This SaaS tool addresses a critical challenge: complex enterprise software often deters efficient adoption because users face steep learning curves. Whatfix leverages AI to hyper-personalize the guidance it provides, dynamically adapting to user behavior to maximize productivity and smooth digital transformation.

Since acquiring Airim in 2019, a startup specializing in AI-driven personalization, Whatfix has embedded these advanced AI capabilities to power hyper-personalized in-app experiences. This foundation has positioned Whatfix to develop intelligent automation tasks that go well beyond traditional step-by-step guidance.

Key elements of Whatfix’s AI strategy include:

- Personalized User Guidance: Real-time, contextual nudges that adapt to individual users’ software usage and preferences.

- Automation of Routine Tasks: Decreasing the number of user steps needed by interpreting user intent and automating workflows.

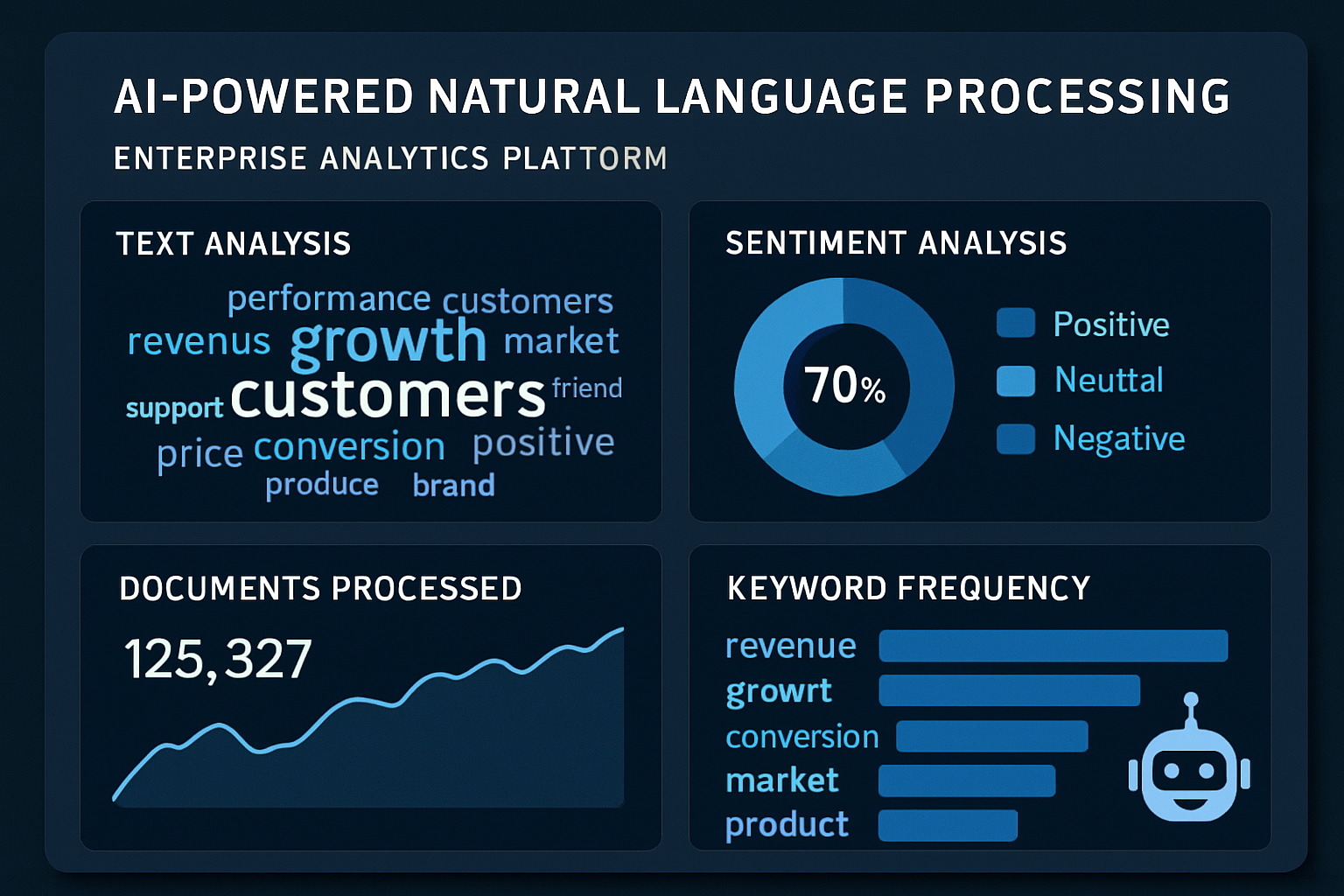

- Enhanced Analytics: Employing AI-driven natural language processing to transform complex analytic dashboards into intuitive, query-based reports that users can easily access and interpret.

- AI Agent Integration: Developing a modular AI agent able to operate across any software system to assist in diverse enterprise tasks, allowing seamless integration even when other default agents are in place.

The anticipated revenue growth from AI-driven products is a testament to the scalability of these innovations and reflects an increasing market appetite for AI-powered SaaS solutions that optimize digital adoption. This focus not only enhances Whatfix’s product portfolio but also captures the growing enterprise demand for intelligent software that boosts operational efficiency.

| Year | AI Product Revenue Contribution | Overall Company Revenue (Projected) | EBITDA Margin |

|---|---|---|---|

| 2025 | 1.5% | $150 million | -27% |

| 2026 (Projected) | 15-20% | $180-200 million | -5% to -6% |

For more details on how startups like Whatfix are transforming tech with AI, see insights on AI video innovations and the influence of new SaaS funnels at SaaS landing pages and funnels.

Enhancing User Experience and Digital Adoption through AI-Driven Automation

User experience (UX) remains paramount in enterprise software adoption, and Whatfix’s digital adoption strategy intricately incorporates AI to redefine UX within complex software ecosystems. Enterprises frequently struggle with low software utilization due to training gaps, cumbersome workflows, and inadequate user support. Whatfix addresses these challenges by combining human-centric design with intelligent automation.

ScreenSense, a proprietary AI technology developed by Whatfix, exemplifies this approach. Rather than guiding users passively through every step, ScreenSense actively detects user intentions early in workflows and autonomously reduces the click count and time needed for critical tasks, such as purchase order creation. This shift from reactive to proactive guidance serves to boost user productivity and reduce frustration.

Automation of workflows through AI agents simplifies software interactions, mitigating the risk that many agentic AI systems are underutilized due to limited user awareness of their capabilities. Whatfix confronts this through AI-powered multi-tasking agents designed to handle diverse tasks across different software platforms without requiring complete overhauls of existing systems.

Key impacts on digital adoption and user experience include:

- Increased Productivity: Streamlined workflows cut down time spent on routine processes, translating to higher returns on digital investments.

- Reduced Training Costs: AI-driven personalization diminishes the need for prolonged user training, accelerating onboarding.

- Higher Software Utilization: Persistent nudges and real-time automation reinforce continuous engagement with enterprise applications.

- Enhanced User Satisfaction: Intuitive interfaces combined with proactive deployment of AI agents improve end-user experience and morale.

This focus aligns with broader market trends where businesses prioritize tech solutions that do not merely digitize processes but make them intelligent. The gradual transition from traditional digital adoption tools to AI-enhanced platforms reflects a critical evolution in enterprise software usage, catering to more dynamic, agent-based interactions.

| Benefit | Explanation | Example Use Case |

|---|---|---|

| Time Savings | Automation reduces repetitive tasks and accelerates workflows | Automatic purchase order processing via ScreenSense |

| User Training | Hyper-personalized nudges shorten onboarding time | In-app guidance modified per user skill level |

| Adoption Rate | Increased software utilization due to seamless support | Persistent AI-agent notifications contextual to user needs |

| Satisfaction | Improved UX leads to higher employee engagement | Faster completion of tasks with less frustration |

This proactive AI-driven digital adoption can be further explored through market insights on AI advancements in healthcare software and evolving automation landscapes within enterprise software.

Strategic Funding and Market Positioning: Preparing for a Successful IPO

Whatfix’s rise in the SaaS and AI-enabled digital adoption space has attracted significant investor confidence, underscored by its successful Series E funding round of $125 million in September 2024. Led by Warburg Pincus, with key participation from SoftBank Vision Fund 2 and investment from industry leaders such as Dragoneer, Eight Roads, and Cisco Investments, the infusion bolstered Whatfix’s valuation to an impressive $900 million.

This capital is strategically earmarked to accelerate the company’s global expansion and deepen AI product innovation. Target markets include the United States, Asia Pacific, and Europe, all regions witnessing surging demand for intelligent software to tackle enterprise digital challenges.

- Global Market Penetration: Leveraging funding to establish localized AI-driven SaaS solutions tailored to regional enterprise needs.

- AI Product Development: Continuous enhancement of AI capabilities, including the rollout of a universal AI agent capable of interfacing with any enterprise software product.

- Strengthening Enterprise Relationships: Integrating AI solutions to enhance the overall SaaS ecosystem for existing clients, providing greater customization and ROI assurances.

- Preparing for IPO: Improving profitability with targeted EBITDA reductions, aiming for break-even as the company approaches its anticipated IPO within two years.

Currently running at an EBITDA of -27% in 2025, Whatfix projects to narrow losses to -5% or -6% by 2026 while increasing revenue, a move that signals strong operational discipline combined with aggressive growth. These financial dynamics are key factors for attracting further investor interest ahead of the public offering.

| Investment Round | Amount Raised | Lead Investors | Valuation Post-Raise | Key Strategic Goals |

|---|---|---|---|---|

| Series E (Sept 2024) | $125 million | Warburg Pincus, SoftBank Vision Fund 2 | $900 million | Accelerate AI innovation, global expansion, IPO prep |

For a broader understanding of AI startup funding dynamics and IPO pathways, readers can refer to Cyera’s recent funding news and emerging trends in AI agent platforms like Amnic’s agentic AI.

Transforming Analytics and Product Ecosystem with AI Integration

Whatfix has recognized that embedding AI into every facet of its product portfolio is essential to evolve and maintain market leadership. While the Digital Adoption Platform continues to drive the vast majority of revenue (approximately 93%), the company is advancing AI applications within auxiliary verticals such as analytics and application simulation software (Mirror).

One of the standout innovations involves transitioning from static dashboard analytics to AI-powered solutions employing natural language processing (NLP). This allows users to simply ask questions in natural language and receive tailored, real-time reports and insights, a transformation that significantly improves accessibility and decision-making efficiency.

Additionally, Whatfix’s AI capabilities are extending towards building dynamic AI agents that do not require exclusive environments or specialized use cases. Their “one-size-fits-all” AI agent is designed to collaborate with a variety of software platforms, ensuring compatibility even with pre-existing default agents, thus enhancing flexibility for enterprise clients.

Major benefits of AI integration into analytics and product ecosystem include:

- Enhanced Decision-Making: Real-time, query-driven insights empower faster and more informed business decisions.

- Broader Accessibility: Democratizing data by removing technical barriers typically associated with analytics dashboards.

- Improved Product Synergy: Seamless AI agent collaboration with various software products increases overall ecosystem value.

- Accelerated Innovation: Faster iterations of AI features with continuous learning from user feedback improving product adaptability.

This cohesive AI strategy not only solidifies Whatfix’s market position but also cultivates a sustainable growth engine through innovation. Further insights on SaaS analytics transformation can be found in recent fintech acquisitions and evolving enterprise analytics trends.

The Future Outlook: Balancing AI Innovations with Core SaaS Offerings

While Whatfix is aggressively pivoting towards becoming an AI-first company, it remains committed to evolving rather than abandoning its core SaaS offerings. Recognizing that enterprise software stacks are notoriously complex and entrenched, Whatfix plans a gradual integration of AI innovations alongside the continued development of its foundational Digital Adoption Platform and related services.

CEO Khadim Batti estimates a mid-term horizon of five to seven years for a fundamental transformation of their core product lines. During this period, customers will witness a blend of traditional and AI-enhanced functionality, ensuring no disruption in service while gradually reaping the benefits of automation and intelligent user guidance.

This balanced approach addresses a key challenge: many organizations hesitate to overhaul their software ecosystems abruptly due to risk, cost, and operational disruptions. Whatfix’s pathway focuses on increasing ROI and user productivity throughout this evolving journey.

Planned enhancements include:

- Continuing Investments to support current product lines while steadily integrating AI capabilities.

- Hybrid Product Experiences where classic digital adoption features coexist with new AI-assisted agents and workflow automations.

- Expanding AI Use Cases beyond task automation to include administrative simplification and personalized user assistance.

- Partnerships with Third-Party AI Solutions to enable interoperable AI co-pilots across enterprise software.

This strategic outlook positions Whatfix as a resilient pioneer in SaaS digital adoption and AI-powered user experience, ready to meet the evolving enterprise demands in an increasingly complex technology landscape.

For broader perspectives on AI integration in tech companies and SaaS evolution, explore innovative startup strategies and scalable AI agent platforms discussed at FireCrawl Y Combinator AI Agents.

Frequently Asked Questions about Whatfix’s AI Innovation and IPO Plans

- How much revenue is Whatfix expecting from AI by 2026?

Whatfix projects that AI products will contribute between 15% and 20% of its total revenue by the end of 2026. - What is the core business of Whatfix?

The company focuses on digital adoption platforms that use interactive guidance to help users better utilize complex enterprise software. - What role does AI play in Whatfix’s product suite?

AI powers hyper-personalized user guidance, automation of workflows, real-time analytics via NLP, and AI agent integration to improve productivity and user experience. - When does Whatfix plan to go public?

The company targets an IPO within the next two years, aligning with its roadmap to achieve near profitability and scale AI offerings. - Will Whatfix discontinue its core products as it focuses on AI?

No, the company plans to evolve its existing products alongside AI innovations over the coming years, ensuring a smooth transition for enterprise users.