In 2025, the logistics technology landscape witnessed a significant breakthrough as Fleetx, a Gurugram-based SaaS startup specializing in fleet and transportation management solutions, closed its Series C funding round with an impressive ₹113 crore investment. This funding round was prominently led by existing investors IndiaMART Intermesh and BEENEXT’s Accelerate Fund, reinforcing the confidence in Fleetx’s innovative AI- and IoT-driven platform. The fresh infusion of capital is set to empower Fleetx to bolster its product capabilities, target extensive expansion across mid-market and enterprise clients throughout India, and accelerate its journey toward full profitability and an eventual initial public offering (IPO).

Founded in 2017 by industry veterans Vineet Sharma, Abhay Jeet Gupta, Udbhav Rai, Parveen Kataria, and Vishal Misra, Fleetx has emerged as a trailblazer in transforming logistics operations. Leveraging cutting-edge artificial intelligence and internet-of-things technologies, the startup offers comprehensive solutions across fleet management, fuel analytics, video telematics, and transportation management systems. These advancements have propelled Fleetx into a domain where it processes vast logistics data, enabling it to solve complex challenges in physical goods movement with unmatched accuracy and efficacy.

With an expanding client base surpassing 2,000 businesses, including giants like Ultratech Cement, Hindalco, Adani Group, Maersk, Vedanta, and Unilever, Fleetx stands as a testament to the escalating importance of technology adoption in the logistics and transportation sector. The company has notably quadrupled its annual recurring revenue (ARR) since early 2022, reaching the ₹100 crore benchmark, a reflection of its scalable SaaS model and rapidly growing market penetration.

The investment round not only represents a strategic alignment with its prominent backers but also sets the stage for Fleetx’s ambitious roadmap focused on harnessing AI for enhanced operational efficiencies and readying the startup for public market access. Industry experts laud this move as a compelling example of how technology-driven startups in India’s logistics sector are attracting substantial funding to spearhead innovation and growth.

Fleetx’s Strategic Use of Series C Funding to Revolutionize Logistics SaaS

In securing ₹113 crore in its Series C funding round, Fleetx is uniquely positioned to expand its technological implementations and market reach within India’s logistics and transportation sectors. This financial boost incorporates both primary capital injection and secondary transactions, indicating not just fresh investment but also liquidity for early investors, a key indicator of startup maturity and investor confidence.

The newly raised funds will be strategically deployed to enhance Fleetx’s product suite, focusing on deepening capabilities in artificial intelligence and Internet of Things integration that address the pressing need for automation and predictive analytics in fleet management.

- Product Enhancement: Incorporating advanced AI-powered fuel analytics and route optimization to reduce operational costs.

- Market Expansion: Heightening outreach to mid-market and large enterprise clients in various sectors such as manufacturing, FMCG, mining, and cement through tailored solutions.

- Sales and Marketing Acceleration: Scaling go-to-market strategies to capture increased demand for sophisticated SaaS logistics solutions.

- Technology Infrastructure: Upgrading core platforms to support real-time telematics and data-driven decision-making across the logistics chain.

- IPO Preparation: Building financial robustness and regulatory compliance necessary for a successful public listing.

By focusing on these areas, Fleetx aims to foster internal capabilities that not only improve operational efficiencies for its customers but also solidify its competitive edge in the increasingly crowded SaaS marketplace. A notable aspect of Fleetx’s strategy includes leveraging its expansive logistics data repositories to develop AI algorithms that reduce fuel consumption, optimize fleet distribution, and enhance driver safety.

| Use of Funds | Objective | Expected Outcome |

|---|---|---|

| AI & IoT Product Enhancement | Develop advanced analytics and telematics features | Improved fleet efficiency and reduced operational costs |

| Market Expansion | Target mid-market and enterprise clients | Increased customer base and revenue growth |

| Sales & Marketing | Scale customer acquisition efforts | Greater market penetration and brand recognition |

| Technology Infrastructure | Upgrade platforms for real-time data processing | Enhanced decision-making and operational control |

| IPO Readiness | Compliance and financial strengthening | Successful public listing on stock exchanges |

Fleetx’s progress mirrors growing trends seen globally, where logistics SaaS startups increasingly utilize funding rounds not just to scale but to innovate rapidly within tech-oriented frameworks. This focus has been identified as a key competitive advantage for startups competing internationally. Examples include other rising startups featured on platforms like side-business.com, which track funding dynamics and startup growth in the SaaS and AI sectors.

Impact of AI and IoT in Transforming Fleet Management and Transportation Systems

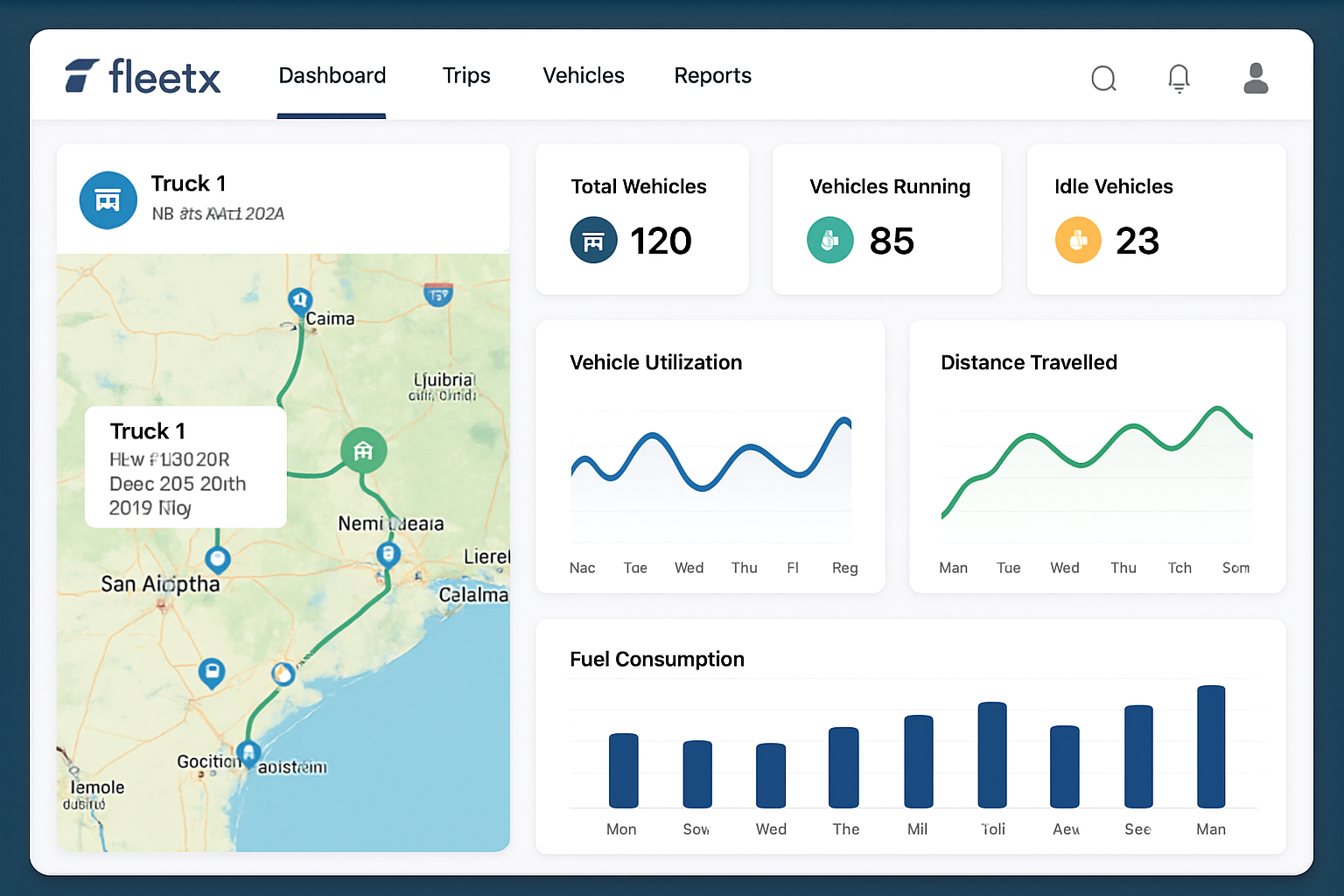

Fleetx’s core value proposition hinges on harnessing artificial intelligence and the Internet of Things to streamline complex logistics operations. AI-powered software enables predictive maintenance, fuel optimization, dynamic routing, and real-time monitoring, dramatically transforming the operational landscape of transportation management.

The integration of AI helps fleet operators reduce downtime by anticipating vehicle breakdowns, cutting unnecessary fuel expenses, and optimizing delivery windows. Similarly, IoT devices feed continuous data streams that enhance visibility and control over assets scattered across vast geographic locations.

- Predictive Maintenance: AI analyses vehicle data to predict failures and schedule proactive maintenance.

- Fuel Analytics: Machine learning models optimize fuel usage, contributing to substantial cost savings and environmental benefits.

- Video Telematics: Real-time video monitoring improves driver safety and compliance with regulations.

- Route Optimization: Intelligent routing algorithms reduce transit times and improve delivery reliability.

- Data-Driven Decision Making: Dashboards powered by big data provide actionable insights for fleet managers.

These technological implementations resonate particularly well with industries where timely and cost-efficient transport is paramount, such as FMCG and mining. For example, clients like Ultratech Cement and Adani Group utilize Fleetx’s solutions to manage their extensive transportation networks across India, capitalizing on the AI-driven insights to keep operations agile and predictive in the face of fluctuating demand patterns.

| AI/IoT Feature | Functionality | Industry Benefit |

|---|---|---|

| Predictive Maintenance | Forecasts vehicle health and schedules upkeep | Minimized breakdowns, increased vehicle uptime |

| Fuel Analytics | Analyzes consumption patterns and recommends efficiency improvements | Cost savings, reduced carbon footprint |

| Video Telematics | Captures real-time footage for safety and compliance | Enhanced driver monitoring and accident prevention |

| Route Optimization | Selects fastest, most cost-effective delivery paths | Improved delivery times and customer satisfaction |

The sophisticated use of technology in Fleetx also aligns with high-tech trends in autonomous vehicle research and smart logistics. While autonomous trucks are still emerging globally, startups like the one featured on side-business.com exemplify the forward direction. Fleetx’s focus on AI and IoT builds a foundation for integrating such futuristic capabilities into existing logistics ecosystems.

Real-world application of these technologies highlights not only efficiency gains but also the strategic advantage they provide amid the intensifying competition for faster and more reliable transportation solutions. Clients report measurable improvements, including up to 30% fuel cost reduction and enhanced fleet utilization.

Investor Confidence and Market Trends Fuel Fleetx’s Growth Trajectory

Trends in the startup investment ecosystem are notably favoring innovative SaaS companies like Fleetx that integrate AI and IoT to solve real-world challenges in large, fragmented sectors such as logistics. The ₹113 crore Series C funding round led by established investors IndiaMART Intermesh and BEENEXT’s Accelerate Fund reflects a broader confidence in Fleetx’s business model, scalability, and potential to capture an increasingly digitalized transport market.

Dinesh Agarwal, CEO of IndiaMART Intermesh, emphasized the alignment of investments with wider corporate visions: “Fleetx’s AI and IoT-powered platform is becoming the operating system for physical movement of goods, dovetailing perfectly with IndiaMART’s mission to empower businesses.” Meanwhile, BEENEXT’s Managing Partner, Hero Choudhary, highlighted Fleetx’s maturation into a “metrics-driven, capital-efficient business ready to scale globally.”

- Strong Product-Market Fit: Solutions tailored for Indian and global logistics challenges.

- Robust Financial Growth: Quadrupling ARR since early 2022 and hitting ₹100 crore milestone.

- Diverse and High-Profile Customer Base: Serving over 2,000 businesses with 100+ large enterprise clients.

- Experienced Founding Team: Deep domain knowledge combined with technology expertise.

- Strategic Investor Participation: Continued backing from IndiaMART, BEENEXT, and others ensures long-term support.

Such investor confidence is especially telling in an era where Indian tech startups must navigate a slowing unicorn influx, as described in recent market analyses. Fleetx’s consistent performance and focus on profitability set it apart as a startup ready to transition from rapid growth to sustainable leadership.

| Investor | Type of Investment | Role in Fleetx | Comments |

|---|---|---|---|

| IndiaMART Intermesh | Primary & Secondary | Lead Investor | Strategic alignment with business growth goals |

| BEENEXT Accelerate Fund | Primary & Secondary | Lead Investor | Focus on scalable SaaS and SaaS metrics |

| Let’s Venture | Secondary (Exit) | Early Stage Investor | Complete exit in Series C round |

The roadmap ahead for Fleetx includes not only aggressive market expansion but also plans to enhance product innovation cycles and increase recurring revenue streams, driven by investor backing that provides a runway sufficient to achieve full profitability and IPO preparation.

Expanding Fleetx’s Footprint: Targeting Indian Enterprises and Mid-Market Giants

Fleetx’s strategic expansion plan focuses on deeply penetrating India’s mid-market and enterprise sectors. These segments represent a vast opportunity given the country’s booming economy and increasing reliance on sophisticated logistics and transportation technologies.

Key sectors targeted by Fleetx include manufacturing, FMCG, mining, cement, and transportation logistics. The startup’s approach involves customizing its platforms to meet specific industry challenges, such as compliance requirements in mining or the heavy asset usage in cement manufacturing.

- Customized Solutions: Industry-specific functionalities catering to manufacturing timelines, FMCG shelf life considerations, and mining safety standards.

- Technology Integration: Seamless ERP and supply chain management system compatibility to provide end-to-end visibility.

- Client Education: Webinars, workshops, and hands-on support to ensure smoother tech adoption.

- Local and Regional Expansion: Tailoring product offerings to various Indian states’ logistical and regulatory nuances.

- Strong Customer Service: Enhancing retention by providing rapid support and continuous updates.

Such strategic moves are designed to not only increase Fleetx’s market share but also deepen customer loyalty. With more than 100 enterprise clients including industry behemoths, the company benefits from strong case studies demonstrating tangible ROI and operational improvements.

| Industry | Fleetx Solution Focus | Customer Benefit | Notable Clients |

|---|---|---|---|

| Cement | Fuel analytics, fleet scheduling, compliance management | Reduced fuel costs, compliance adherence | Ultratech Cement, Ambuja Cement |

| FMCG | Real-time tracking, inventory movement insights | Optimized delivery, reduced spoilage | Unilever, Nestlé |

| Mining | Safety monitoring, equipment utilization | Improved safety records, enhanced asset performance | Vedanta, Adani Group |

| Transportation | Route optimization, driver behavior analytics | Lowered operating costs, enhanced service reliability | Maersk, TVS Logistics |

Fleetx’s growth strategy is supported by initiatives similar to those described in reports on startup fundraising and SaaS scaling, such as D Spark’s approach to manufacturing funding or automating SaaS sales funnels, further demonstrating industry best practices applied in logistics tech startups.

Frequently Asked Questions on Fleetx, Series C Funding, and Logistics SaaS Trends

- What does Fleetx’s Series C funding signify for the Indian logistics SaaS market?

It underscores growing investor confidence in AI- and IoT-enabled logistics solutions, pointing to technology’s pivotal role in transforming India’s transport infrastructure. - How does Fleetx leverage AI to solve logistics challenges?

Fleetx utilizes AI for predictive maintenance, route optimization, fuel analytics, and real-time telematics to improve fleet utilization and reduce operational expenses. - Who led the latest funding round for Fleetx?

The Series C round was led by existing investors IndiaMART Intermesh and BEENEXT’s Accelerate Fund, highlighting long-term strategic partnerships. - What are the key industries benefiting from Fleetx’s solutions?

Cement, FMCG, mining, and transportation sectors are prime beneficiaries due to their complex logistics and transportation needs. - How does Fleetx plan to use the new funds raised?

The funds will be used to enhance AI and IoT product features, expand market reach in mid and large enterprises, strengthen sales and marketing efforts, upgrade technology infrastructure, and prepare for an IPO.